What is the Public Perception of Taxes?

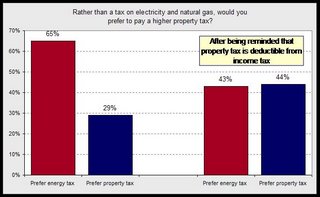

It is interesting that citizens do not know more about their local government taxes. Citizens are using local government services daily (water, sewer, garbage, libraries, roads, parks) yet, they have no idea how these services are funded. And a better question is, do citizens change their tax preferences with increased knowledge? This graph illustrates data from our Dan Jones conducted Tax Survey that indicates, that yes tax preferences do change with increased knowledge.

This is the issue Brian Roberts and I explore in our paper Citizen's Blank Check. We presented the findings of our study last week at the APPAM (Association for Public Policy Analysis and Management) conference in

One interesting suggestion was to explore whether new homeowners have better property tax knowledge than "seasoned" homeowners. The logic is individuals who have made a recent home purchase have looked closely at their property tax bill for the new property. I'm not sure what the results would be, I'm inclined to say that it wouldn't matter. Maybe it will be something we'll look to explore more. In the meantime (if you are very inquisitive or love taxes) you can read our paper here.

No comments:

Post a Comment